ICONIQ - State of AI report

Regular readers will know I am a big fan of ICONIQ Capital’s reports - with a strong focus on Go To Market they provide great insights for tech companies.

Last week they published their “State of AI” report, helping executives to navigate the present and promise of Generative AI.

If you are a leader trying to carve your organisation’s path through the AI hype and understand how to drive real business value I recommend downloading the report.

In this post I’ll highlight a few charts that really stood out.

Before I do - quick clarification on who the respondents were.

ICONIQ spoke to 215 executives during June 2024 at companies with more than $500m annual revenue - CEOs, CIO, CTOs and some functional leaders.

There was a good blend of industries with only 33% being technology companies.

91% of them were headquartered in the US, 7% in the UK and 2% elsewhere.

Start with cost reduction, then grow revenues

The respondents see three main goals for AI investments and they tend to follow a sequential path.

One goal missing here which I often hear executives discuss is about reducing or mitigating risks - whether financial, cyber or other forms of risk. One to keep an eye on.

Remember - the biggest opportunity from AI is developing new and improved value propositions for your customers - so the quicker you can get to number 3 on this graphic the better.

AI budgets exist, and they are getting bigger

The report shows that 88% of companies have an approved budget for generative AI investments.

59% of respondents are pulling from an existing R&D budget, 57% have created new AI specific budgets, with others also pulling from innovation or business unit budgets (this was multi-select so totals more than 100%)

CxOs expect these budgets to grow by an average of 22% in 2025.

AI is a C-level topic

When asked who makes the decisions about AI-related purchases it is interesting to see the rise of a new role - the Head of AI/Chief AI Officer, as well as the CEO being listed third.

This is not a technical purchase - this is about changing the way the entire business works and the CEO is a key stakeholder in that change.

ROI is starting to be seen in top use cases

Many AI projects are still experimental proofs of concept, but now around 60% of projects have a defined use case.

The most common use cases delivering tangible value start in customer services (chatbot anyone?!) but increasingly other functions are learning how to benefit from AI in their own work.

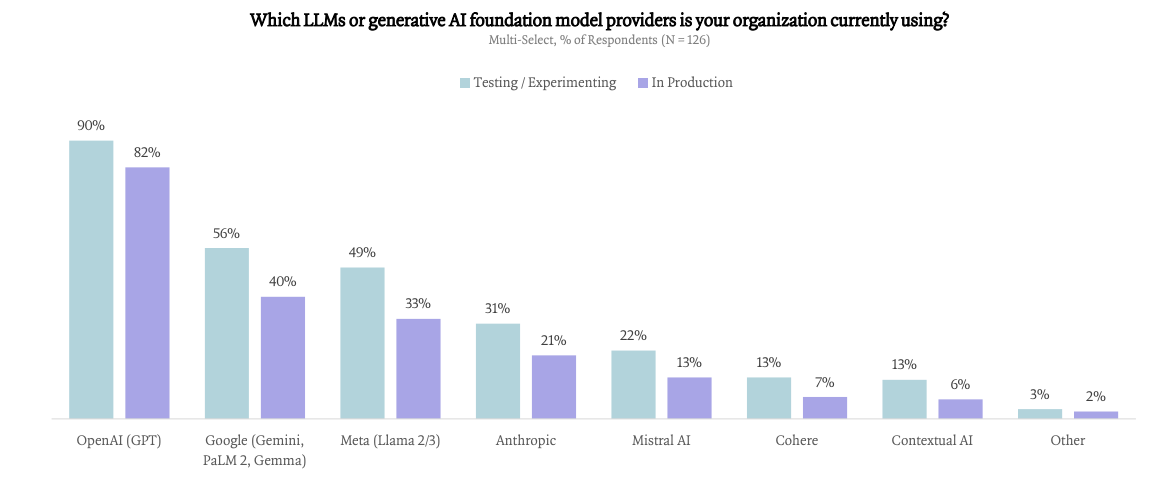

ChatGPT dominates the model war

We live in a multi-model world, but OpenAI’s ChatGPT is the leader of the pack with 82% of respondents saying they have production use cases with their models.

Pay close attention to Google in second - distribution is king, and keep an eye on Meta’s open source Llama model for companies that want to ‘own’ their models.

Cohere is very focused on enterprise use cases, so expect to see their adoption increase in future reports.

Building a composable architecture

The models are important, but to provide your teams with a safe, governed and compliant system companies are building out composable AI architectures.

Many new vendors are popping up to support each of these categories.

Business team use cases drive adoption

The report closes out with function specific slides like this one for finance.

To drive adoption you need to take the business process to AI, not vice versa, so having clear understanding of the daily, weekly and monthly jobs-to-be-done in each each team will open your eyes to quick wins.

Get reading!

Its a great report, and I’ve just touched on the insights within it. I fully recommend downloading it yourself.