6Sense Buyer Experience Report 2024

6Sense recently released their 2024 Buyer Experience Study, and it is essential reading for anyone in a B2B revenue leadership role.

It will challenge how you think about the way your Go To Market teams build pipeline with your target customers.

The study surveyed 2,509 recent B2B buyers from across a range of industries, job levels and geographic regions.

The purchases were all over $10,000 (so not a quick credit card payment online) with an average deal size between $200,000 and $400,000.

The report runs to a full 65 pages, and I encourage you to read it in full, but to inspire you I’ll pull out a few of the key learnings and summarise my advice.

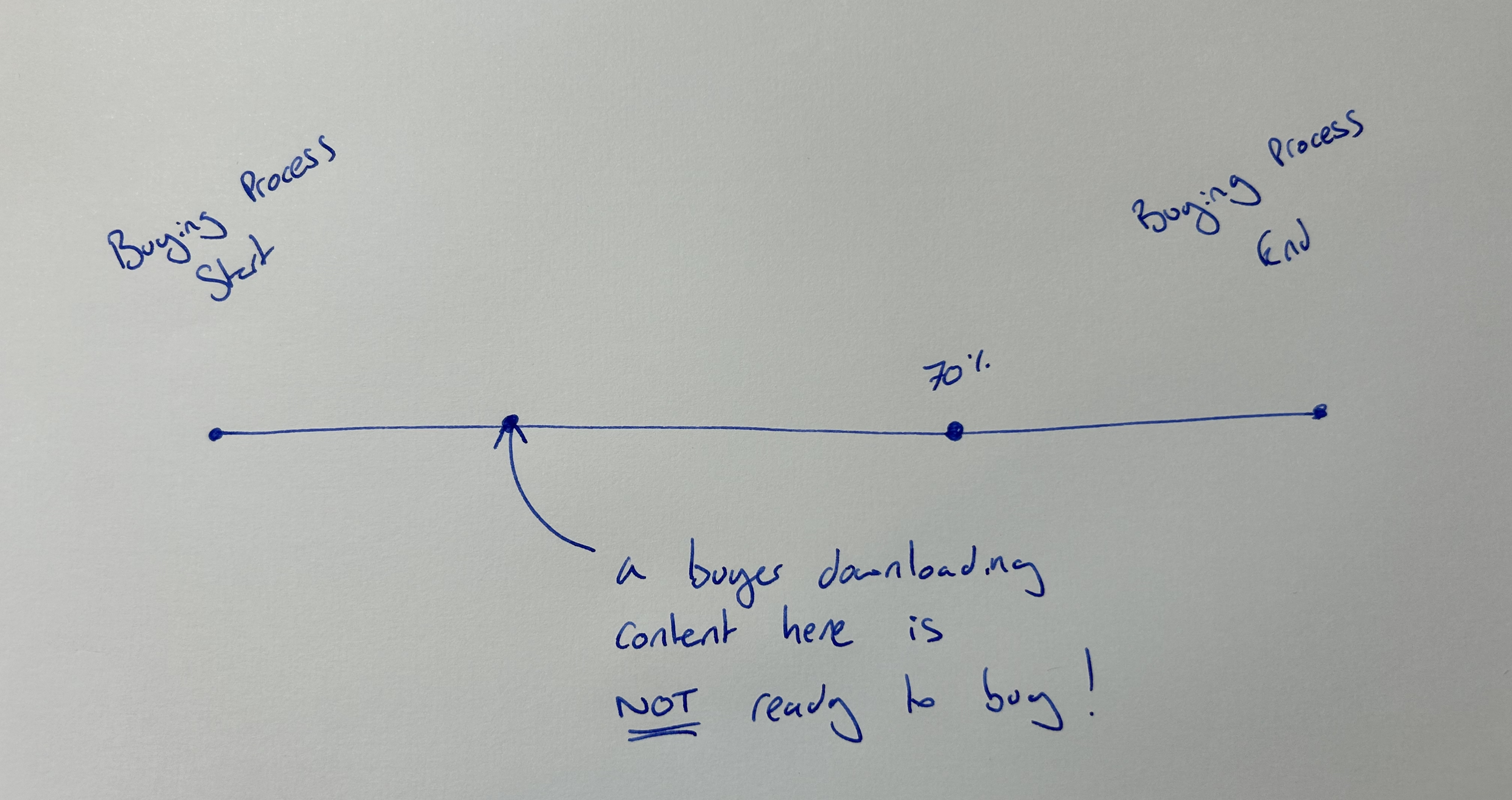

B2B buyers are nearly 70% of the way through their buying process before engaging with sellers

Wait, what? You’re telling me that buyers have their own buying process and it is not 100% correlated to the sales stages we have in our CRM?!

Yes, buyers have a lot to do before a buying process gets anywhere near a vendor - they need to identify the problem, assign a monetary value to that problem, and understand if they could solve that problem with what they have, or a change or process, or some consulting work.

A lot has to happen before they come to the conclusion they need to buy something new to solve that problem.

Buyers initiate first contact with sellers more than 80% of the time

Wait, what? I thought it was our SDR’s amazingly worded “noticed you’re hiring…” email that got these buyers on the hook?

No, buyers are already in the driving seat of their buying process and they choose who to speak with and when.

For some lucky SDR their email or call has likely landed in the right email box on the right day - but it is their timing that has made them successful, not their “got 30 seconds to explain why I called?” talk track.

Buyers contact the winning vendor first more than 80% of the time

What, what? But I thought it was a fair race and we always have a chance even if we ambulance-chase accounts showing intent?

No, the study shows that buyers (who have already spent 70% of their buying process without you) have a very good idea of what they want before they pick up the phone or respond to the lucky SDR’s email.

If you weren’t the first company they called, you are extremely unlikely to be selected.

Average buying cycles are 11.5 months in length

Wait, what? Our average sales cycle is 3.5 months so how can that be?

See point 1! The buyer is already 70% of the way through their buying process before your sales cycle starts.

As a sub-note the report shows that around 70% of buyers introduce external consultants to help them with their buying process, and when this happens it doubles the buying process length on average from 6.5 months to 13.6 months (the 11.5 months is an average of all respondents).

So what does this mean for Go To Market teams?

Should we give up selling and just wait for the phone to ring?

Absolutely not.

This study shows that it is even more important to think about the 70% that happens before you get involved and to consider how to help your buyer with their buying jobs in that step of their process.

Gartner break down the buying process into 6 discrete steps:

Problem identification - we need to do something

Solution exploration - what’s out there to solve our problem?

Requirements gathering - what do we need this thing to do?

Supplier selection - does this thing do what we need it to?

Validation - we think we know what to do but need to be sure

Consensus - let’s get everyone on board

The 70% of the buying process that the study highlights are those first three steps - do we have a problem worth fixing, how might we fix it, and if we do need an external solution (a new vendor) what do we need it to do?

One answer to this is creating valuable buyer enablement content.

Diagnostic tools

Calculators

Benchmarks

Process flows

Project plans

Interactive tools that help the buyers to understand their own context and move their own project forward.

Stop trying to sell to buyers that aren’t ready

The problem many companies suffer is that having created valuable buyer enablement content they put it on the website, gate it, and then funnel hot ‘leads’ through to the SDRs or AEs.

“We’ve got a live one!!”

But we’ve learned that a buyer downloading and consuming this content is nowhere near being in a buying situation - they are in their research and learning phase.

The SDR calls, “I’d love to get you on a demo with my AE….is this something you are looking to purchase by the end of this quarter?”

They are talking a different language resulting in no shows, slipped meetings and “closed no decision”

Instead, we need SDRs (or whoever the first responder is) to be far more consultative in their messaging and stop trying to sell the meeting:

“Typically when people download this calculator they are right at the start of their buying journey - months off wanting to speak to vendors.

That said, we do have a weekly webinar focused on how to use that calculator to help you understand your current state and develop your internal business case.

Other customers have said it really helped them get their internal teams aligned at the start of their research”

To make this work well, you need that first responder’s comp plan to be different to the “meetings booked this week” - they must be comfortable with the fact the conversations they have today will likely not surface into a meeting for five months.

And when that call does come in (if they call you first) you have an 80% probable deal on the table.

Grab the report

I absolutely encourage you to download this report - to find a quiet space, and a notepad and write down some of the stats that are specific to your deal size, and your region.

As you now look across your SDR and AE team hammering the emails and phones:

“Noticed you’re hiring a new…..”

“Saw you downloaded our ebook…..”

I think you’ll want to change the tone of their conversation to focus more on supporting buyers with their buying jobs and less trying to push them for a meeting they aren’t ready for.