How to build your company’s industry knowledge

We know that executives are becoming even more involved in decision making as the spending of every single dollar is interrogated.

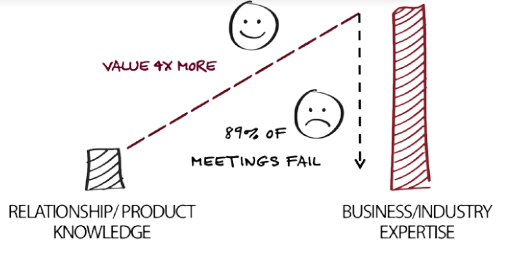

In a recent Corporate Visions session I saw some statistics we can all relate to:

Executives value a business conversation 4x more than they do a product conversation,

And yet according to Forrester Research, in 9 out of 10 executive meetings the salesperson fails to demonstrate they understand the real business problems the executives are facing.

Executives want to have a discussion about their specific challenges - specific to their industry, to their size, to their geographies and to their role.

And yet SDRs and AEs that have had no formal education in these topics can do nothing else other than fall back to their product and features.

What does 21-year old Simon who’s just finished a media studies degree know about the clinical trials process in pharmaceutical development?

Companies put too much focus on their AEs to learn about their customers

As you bring in new AEs that waved their industry experience and rolodex of contacts around in their hiring process, too many companies rely on the AEs themselves to own the industry knowledge for the accounts they are selling into.

“This is Hannah, she is a Fins AE - she has worked with Citi and Barclays and understands the financial services space”

Three main problems with this approach.

Hannah likely became a Fins ‘expert’ having closed a warm inbound deal and picked up the language around capital markets and investment banking as part of the deal cycle. As such she then knew more about financial services than any other AE and became the go to for other financial services opportunities.

Hannah was selling a different product at her previous company, maybe to a different set of personas - so she was likely solving a different set of problems for a different set of people and doesn’t have the deep understanding about the problems your product solves.

The average productive tenure of an AE is 22 months. During that limited time, Hannah is still learning about your products and people, she is prioritising her territory (which probably doesn’t include the same accounts she has experience of), and then planning her next move.

No disrespect to Hannah - these are some of the best AEs who can pick up a new challenge and turn it into closed business.

The problem is, when Hannah leaves, your company is no further forward in having financial services knowledge than it was before she arrived.

You need to build institutional customer segment knowledge

As you scale up your Go To Market team, you should consider how to develop your own institutional customer segment knowledge that is independent of the AEs you bring into the team.

Industry - Financial Services, Media, Retail, CPG…..

Company Size - SMB, Mid-Market, Enterprise, Strategic

Geography - North America, LATAM, EMEA, APAC - and each country within is unique

Personas - CFOs, CIOs, CHROs…

You can then use this knowledge to train and coach your SDRs and AEs as they come into the company.

Step 1 - do you have this knowledge in your company today?

When you set the company up, you likely scratched your own itch - you had domain expertise for that specific problem:

“I had trouble onboarding new employees into our SMB company so we designed an onboarding product to solve the problem”

Once you reach Product Market Fit and start to expand your TAM into new industries, customer sizes, geographies and personas you need to ask yourself if you still really understand the problem your new customers are facing?

Consider who in your company may have the right knowledge:

Executives - does anyone on your senior team have recent relevant experience for a customer segment?

Investors - does anyone on your Cap table have recent relevant experience, or do they have other portcos that do?

Employees - has anyone recently moved into tech that was recently in a relevant segment? Have team members moved in from a customer and can share their experience?

Be critical - just because someone worked in, or sold to, or shopped at a retail company previously does not make them an expert on the retail industry.

For most companies it is safe to assume that you don’t have the detailed knowledge for each of your sectors internally.

Step 2 - Nominate an owner for customer segment knowledge

The way that your marketers develop their campaigns, your sellers help customers to buy, that your CSMs help your customers get value from your product, even how your product team define and prioritise your roadmap is driven by deep institutional knowledge of your customer’s businesses.

This exercise is too important not to have an owner.

In a recently funded Series A company you’ll be scaling your GTM team from around 15 to 70 people, and within that your Revenue Operations team will scale from just one, to around 5 team members under a Revenue Operations leader.

One of the Revenue Operations team will have an enablement role, and they can be the named contact for customer segment knowledge for now.

As you scale further you can make this a dedicated role and subsequently have discrete owners for each industry or segment.

Step 3 - Prioritise one customer segment to begin with

Focus your efforts on getting this right with one customer segment first, before using this process to expand your knowledge into other segments.

Pick a customer segment that is your biggest short term opportunity and that you are ready to invest in marketing and selling to immediately.

You will want realtime feedback from prospects to learn from the knowledge you acquire and the way you present that to them.

Step 4 - Find who has the knowledge outside of your company

Having agreed that the domain expertise you need doesn’t exist in your company, you need to go and find where it does exist.

You need to grow fast, so you need someone that can tell you what you need to know - don’t point a junior enablement role at ChatGPT and ask them to find out what priorities a CPG CIO has.

Niche analyst firms - Gartner, Forrester and IDC all have industry and segment specific reports, but depending on your scale these may be overly costly. Look instead for niche firms that focus in on a subset of customer segments.

Independent consultants - ex-employees of commercial organisations provide consulting back into their previous industry. These consultants have recent and relevant experience you can build on.

Niche consulting partners - you may already partner with smaller consulting firms who help your customers implement and maintain your solution. If they have a focus on a specific industry they will have experience you can build on.

The larger consulting firms - Accenture, Deloitte, Bain, McKinsey, BCG all provide detailed industry content on their websites that can be incorporated into your knowledge.

Technology partners - your solution may integrate with larger technology firms - Salesforce, Workday, Microsoft, Google. All of these companies have invested in their own industry specific content which is easily accessible on their websites.

Don’t just research - find someone you can debate and test your propositions with.

It is possible to conduct research and develop a baseline understanding of the challenges that a customer segment is facing, but you need to be able to have a two way dialogue where you can test your understanding and your proposed messaging.

“That won’t resonate”

“That’s not a priority for execs”

“That person isn’t responsible for that part of the business”

“Have you spoken to this industry specialist?”

It’s likely this will be a paid engagement - a limited scope project to start with, and an ongoing retainer to keep your proposition up to date.

Step 5 - Develop a customer segment playbook

Your playbook is where you document your approach to marketing and selling to this customer segment for your GTM teams.

As new marketers, SDRs, AEs, AMs, CSMs join the company this is where they come to find out about how ‘we’ sell to financial services, to SMBs, to German clients.

Keep it digital - this is going to be constantly updated so don’t fall into the trap of a PDF ebook or printed booklet that becomes trapped in time and a desk drawer.

Whether you use an intranet, Google Drive, or an enablement platform like Highspot or Seismic - make sure it is easy to find, easy to consume, and includes multi-format content including audio, video and images.

Highspot uses a really simple four step play format:

What to know: what do your GTM team need to know about this customer segment - market size, leading companies, how the customer segment is structured, common regulations.

What to say: what should they say to your customers, including call recordings of what good looks like and sample questions and discussion points.

What to show: what they should show to your customers - industry specific graphics, webinars, videos, documents, FAQ’s, customer references.

What to do: what customer segment training or coaching should the individual do? Read a specific industry report, take a short training program, record them presenting the industry talk track for their manager to coach them on.

Step 6 - use your customer segment knowledge to drive your funnel metrics

Now you have institutional customer segment knowledge you can embed this in every step of the buyer’s journey - from initial discovery of your category and company, through to their solution exploration and validation, and eventual decision making.

Your aim is to create content that helps Executives, your buyers, your partners, your own Go To Market teams understand the problem that they are facing.

Don’t be too quick to fall into the solution trap “and here’s how we are the best way of solving it….”

Top of funnel - graphics, blog posts, webinars, research papers specific for this customer segment

Mid-funnel - focused breakfasts, speaking engagements (using your independent consultant), round table events, networking dinners

Bottom of funnel - segment specific onboarding plans, project plans, integration architectures, customer reference calls, business case templates

Step 7 - Renew and refresh your customer knowledge

The world moves faster every day.

Climate change, geopolitical change, economic change, technological change.

We just need to look at the pace of development in AI and see how many industries are prioritising that compared to 12 months ago.

Developing institutional customer segment knowledge is not a one time project.

As you hire in new AEs with domain knowledge incorporate what they have to share.

Revisit your partners, analysts, consultants and update your knowledge based on what they are hearing in the market.

Ensure your sales teams, especially new starters, have access to your updated point of view on the customer segments they are selling into.

Having built and maintained your institutional customer segment knowledge, the next time an AE does decide to move on, you won’t be worried they are walking out the door with everything your company knows about the media business.

Get started

Whenever you are ready, there are three ways that I can help you accelerate your revenue.

Buyer Experience Audit - I’ll impersonate a buyer researching your segment and company and let you know what I find. Ideal for planning your Revenue Operations strategy.

Business Model Design Workshops - I’ll work with you and your team to design or refine a business model for a new or existing product.

RevOps Impact Playbooks - I’ll help you implement one or more tactical processes across your revenue teams - content, referrals, testimonials, adoption and more.