CFOs. Use money as a strategic weapon

Every company I have worked in has had a very traditional relationship with money.

A contract is signed with annual or quarterly billing

An invoice is sent (with 30, 60, even 90 days terms)

Accounts Receivable chase that money

Eventually it gets paid via bank transfer

The cycle repeats

But payments technology gives forward thinking CFOs and their executive colleagues the opportunity to define new business models and products.

The shift to Direct To Consumer (D2C)

Apple pioneered the trend with retail stores to build a direct relationship with their customers.

And whilst you can buy your Dyson vacuum from a retailer, they also promote the direct channel - see at the bottom of this Twitter ad - “Buy direct from the people that made it”

And its not just consumer brands.

Many large healthcare or manufacturing companies have strategies to connect directly with their enterprise customers.

This graphic is the strategy of Sandvik, a global manufacturer supplying the mining industry. One of their key strategies is making the digital shift and building a direct relationship with their customers rather than solely working through a dealer network.

Companies are driving this trend because they can:

Build a direct relationship and get feedback

Improve their customer’s experience

Market directly to their customers

Customer Experience - increase the flow of cash into the business

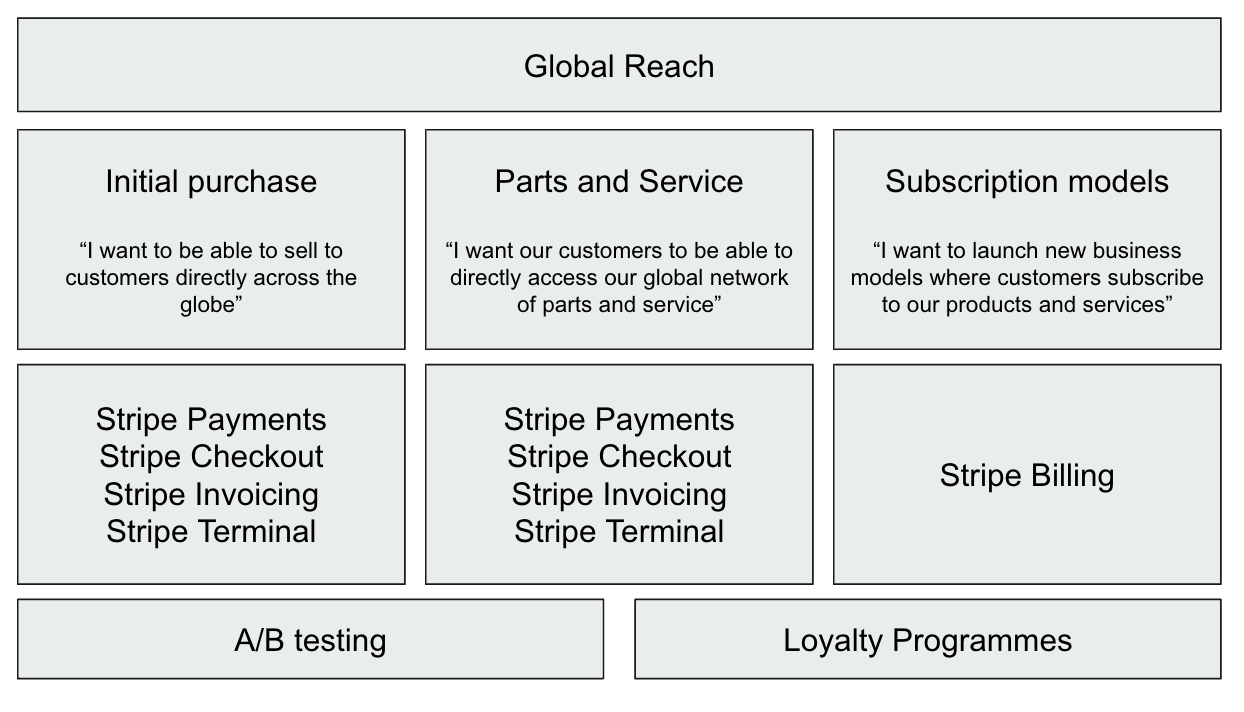

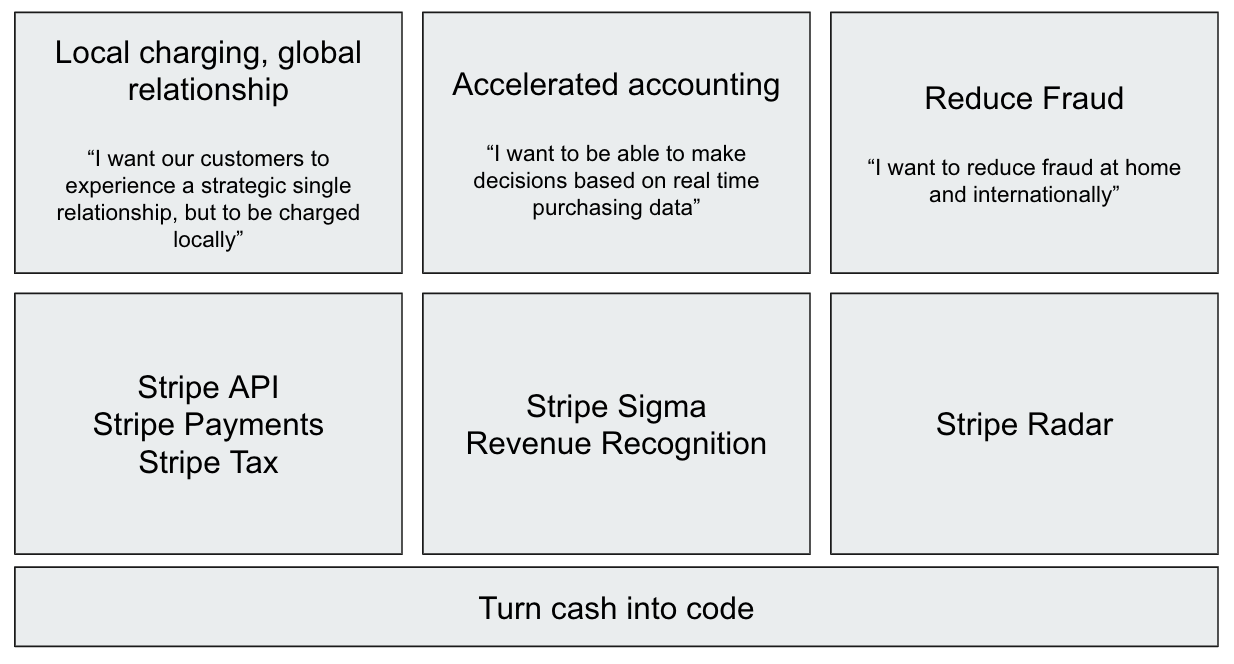

I’m going to use Stripe products as an example as I walk through these opportunities.

CFOs and the executive team should not focus on the how, but more on the ideal strategic goals which I have proposed in the top of these graphics.

Traditionally for a manufacturer to sell products in different countries they engaged local dealers who could handle the local relationship.

But as more of a manufacturer’s offering becomes digital - the physical product is not the product (today only 31% of a manufacturer’s profit comes from the product itself).

Leaders should challenge their own past thinking about why they use a distribution network, or complement that with a direct relationship.

Two opportunities arise:

A/B Testing - the ability to test different pricing models or bundles with customers at short notice. This is difficult or impossible to do via dealers.

Loyalty Programmes - by having a direct relationship with customers loyalty cards, incentives, access and kudos can be provided to customers.

Local Partners - a company in a box

Dealers still provide valuable physical support to customers, so can payment platforms improve the way CFOs manage those relationships?

Traditionally dealers are responsible for keeping their own records of what they sold, who they sold to, what they charged - and then once a quarter the manufacturer would physically audit the dealer - “let me see the contracts, the invoices and validate what you said you sold is what you did sell.”

It is 2023!

With payment tech you can provide your dealers with a much better way.

Take ownership of that payment flow even when processed by the dealer locally.

Specifically that can allow you to offer rebates and discounts to a customer based on their global relationship, or to immediately offer the dealer additional incentives for supporting a current offer or product launch.

Business Operations - use money as a strategic weapon

I borrowed this phrase from an article about how Uber grew so quickly in the early days - they used their funding as a strategic weapon.

Instead of thinking about discrete bank accounts, currencies, accounts payable, dealers - start to think of your global money as a strategic advantage against your competitors.

By turning your cash into code you can move faster - recognise revenue faster, developing global relationships with your global clients and limiting fraud.

New products, new services

I recommend getting your top team into a room - across finance, product, sales, marketing, customer success and walking them through these three graphics as inspiration.

Then look at your own organisation’s relationship with money.

Can you do things in a different way that open up new product lines, new routes to market, new ways of servicing your customers?

Use your money as a strategic weapon!

Get started

Whenever you are ready, there are two ways that I can help you accelerate your revenue.

Buyer Experience Audit - I’ll impersonate a buyer researching your segment and company and let you know what I find. Ideal for planning your Revenue Operations strategy.

RevOps Impact Playbooks - I’ll help you implement one or more tactical processes across your revenue teams - content, referrals, testimonials, adoption and more.