7 strategic metrics CxOs can improve with Gong

If you aren’t using Gong to record all your company’s calls then you are missing out on some unique opportunities to increase your revenues and cash in the bank.

Gong is a call recording platform. It does three things:

Captures conversations (whether audio, email or more commonly video)

Analyses the content of those conversations

Delivers insights on individual deals, on teams, and on the entire market

Companies typically roll it out to their salespeople, suggest to managers that they use it for coaching, and leave it at that.

Which is a huge waste.

As a leader there are more valuable ways that you can use this platform.

Gong is the dashcam for customer conversations

Think of a dashcam in a car. Its always recording. It doesn’t know what it is going to record when you set off. But, if something interesting does happen, you know you can go back and find it.

Gong is the dashcam for customer conversations

Gong is the same for customer conversations. Your company has hundreds of calls with customers that aren’t specifically sales calls - negotiation calls, legal calls, onboarding calls, project sign off calls, payment collection calls, quarterly review calls, product launch calls, renewal calls.

Individually these calls might not contain groundbreaking insight - but taken as a large dataset, they allow you as a leader to derive insights that enable you to direct the business.

Record every call

A dashcam only works because it is on all the time, and the true value of Gong comes from recording every call - not just those that you think might be useful beforehand.

While sales coaching is a valuable use of Gong, by focusing in on that use case you miss the legal calls, the onboarding calls, the weekly CSM checkin calls, the product release calls.

You want to have a healthy culture of call recording where all of your customer facing teams are comfortable that it is the conversation that is being recorded, not the individual.

Reinforce to your team, “As a company, we record all our customer calls - we do this because it helps us to build better products, to build a better buyer and seller experience, and to help us accelerate the growth of the business”

And for your customers, “We record all our calls to ensure that we provide you a better buyer experience. It helps us with providing smooth handovers, allows us to ensure we followed up on all our commitments, and to concentrate on listening rather than writing notes.”

Note: you will need to get consent from all parties, but this can be done in a non-intrusive way with a personalised consent page. Very few customers decline the recording and if they do that is a signal in itself.

Now that all your customer calls are being recorded you can start to integrate your call recording data with other systems to drive business insight.

Access Gong call recordings in your BI platform

If you use Snowflake Data Cloud, your call recordings are available instantly via the Snowflake Marketplace.

Gong recordings are available to report on in Snowflake

Alternatively you can use Gong’s API to pull call recording data into your preferred Data Warehouse and BI tool.

Your call recording data is powerful on its own, but it becomes supercharged when you merge it with other internal data (CRM, product usage, finance, CLM, HR) or external data (intent, weather, technographic, economic) sources.

Seven strategic metrics to manage.

Start with the metrics you discuss in your board meetings and work back to the call recordings.

Average Selling Price (Discounting)

Discounting is one of the easiest way to erode firm value. The hard work to be selected is done, but at the end of the quarter, concessions are given that reduce the profitability of a customer, in some cases to below zero.

Let’s find out why this happens.

In your finance platform filter on customers that have the lowest margins at each user tier (ie the ones that have been provided the biggest discounts).

Go back to the sales calls and understand how these negotiations took place.

Who was involved on your side and the customer’s side?

When did they take place (date in the month, day of the week, time of the day)?

Were agreements made on the call or afterwards on email or follow on calls?

Who suggested the discount? The customer, the AE, the manager?

Was there a plan or were your team reactive to the customer’s requests?

Was there any pushback or alternatives suggested?

What was the customer’s walk away option if the pricing wasn’t agreed to?

Days Payable Outstanding

Revenue is vanity, profit is sanity, cash is reality.

The slowest payers are often your biggest accounts and large delayed payments limit your strategic choices.

In your accounting platform filter on accounts that take the longest to pay.

Go back to the sales and onboarding calls and look for any insight around why this might be.

Are there concerns with the product?

Were they reluctant to introduce your team to senior executives?

Was there a supplier onboarding process that wasn’t followed?

Did your sales team request the relevant purchase order details?

Did the customer provide information for the invoice that wasn’t passed on?

Was there confusion about the pricing model and how the customer can reconcile invoices?

Who at the customer might be able to help reset the relationship.

Non-standard contractual terms

As you start selling into Enterprise your larger customers will try to move you away from your standard on-line Terms and Conditions.

These negotiations can soak up a lot of time as your lawyers tussle over ‘who’s paper’ they want to start with and whether 1x or 2x limitation of liability is acceptable.

These negotiations can cause deals to slip from one quarter to the next, but can also introduce a higher cost of serve as customers need to be supported in a non-standard way to deliver your contractual obligations.

In your Contract Lifecycle Management platform (ie DocuSign or Ironclad) build a filter on customers that have the highest number of non-standard terms.

Split this by contract size, country, or product type to give you better insight.

Go back to the calls and understand the negotiation flow.

Who was included from your team’s side?

Who was included from the customer’s side?

How was the negotiation handled - phone, video, email, CLM?

Did you provide fall back clauses or just accept the customer’s suggestion?

Did the urgency of end of month affect the conversation and negotiation?

Who broke the pauses?

What can you learn by comparing these to a set of customers on more standardised contracts.

Product usage (adoption)

Poor product adoption is a strong predictor of churn and is typically initiated much earlier in the sales and onboarding process.

A customer might not have needed a specific module, or not understood the problem it solves when they signed up to it.

In your product analytics platform filter on a set of customers that have low adoption of a specific module or feature.

Go back to the sales and onboarding calls to look for discussion around this feature.

What questions did the customer have?

Did they have a problem that this feature solved?

Did we rush the demo?

Did the customer introduce a different set of business users for the newer feature?

Did the customer engage with the onboarding session for this feature?

Is the feature missing a common requirement that needs to be developed?

Net Revenue Retention (Upsell/Expansion)

In a SaaS business expanding the revenue from your existing customers is a key predictor of future growth.

But what can we learn from earlier in the process that might be a predictor of upsell and expansion?

In CRM or your finance platform filter on customers that have the highest upsell and expansion as a percentage of revenue.

Go back to their sales, onboarding and regular CSM calls to look for discussion around the new products, or increase in usage.

How were these conversations initiated and by whom?

Was a roadmap or roll-out plan discussed?

How did the AE/CSM introduce the idea of increasing usage?

What reservations did the customer have about when they made the additional purchases?

Who did the customer bring to the Quarterly Business Reviews led by your CSM?

What understanding did your team have of the customer’s strategic priorities?

What was said in the upfront sales calls is a predictor for upsell six or 12 months later?

Gross Revenue Retention (Churn)

Gross Revenue Retention looks at the amount of retained revenue year on year without accounting for upsells and expansion.

GRR of 90% means that if a set of customers billed $1m last year, then this year that would reduce to $900k as 10% of the revenue churned. Can we learn why this 10% churns and if there is anything we can do to prevent or avoid it?

In CRM or your CSM platform filter on customers that have churned (logo churn or revenue churn).

Go back to the sales, onboarding and regular CSM calls to look for mention of challenges or potential mis-selling.

Did the customer think they were getting one thing and got another?

Was the customer in your ideal customer profile?

Who was involved in the buying process from the customer?

Did the salesperson say anything misleading to the customer?

What was the handover from seller to onboarding to CSM like?

At what point in the process did the customer’s tone change from happy customer to potential risk?

AE attrition

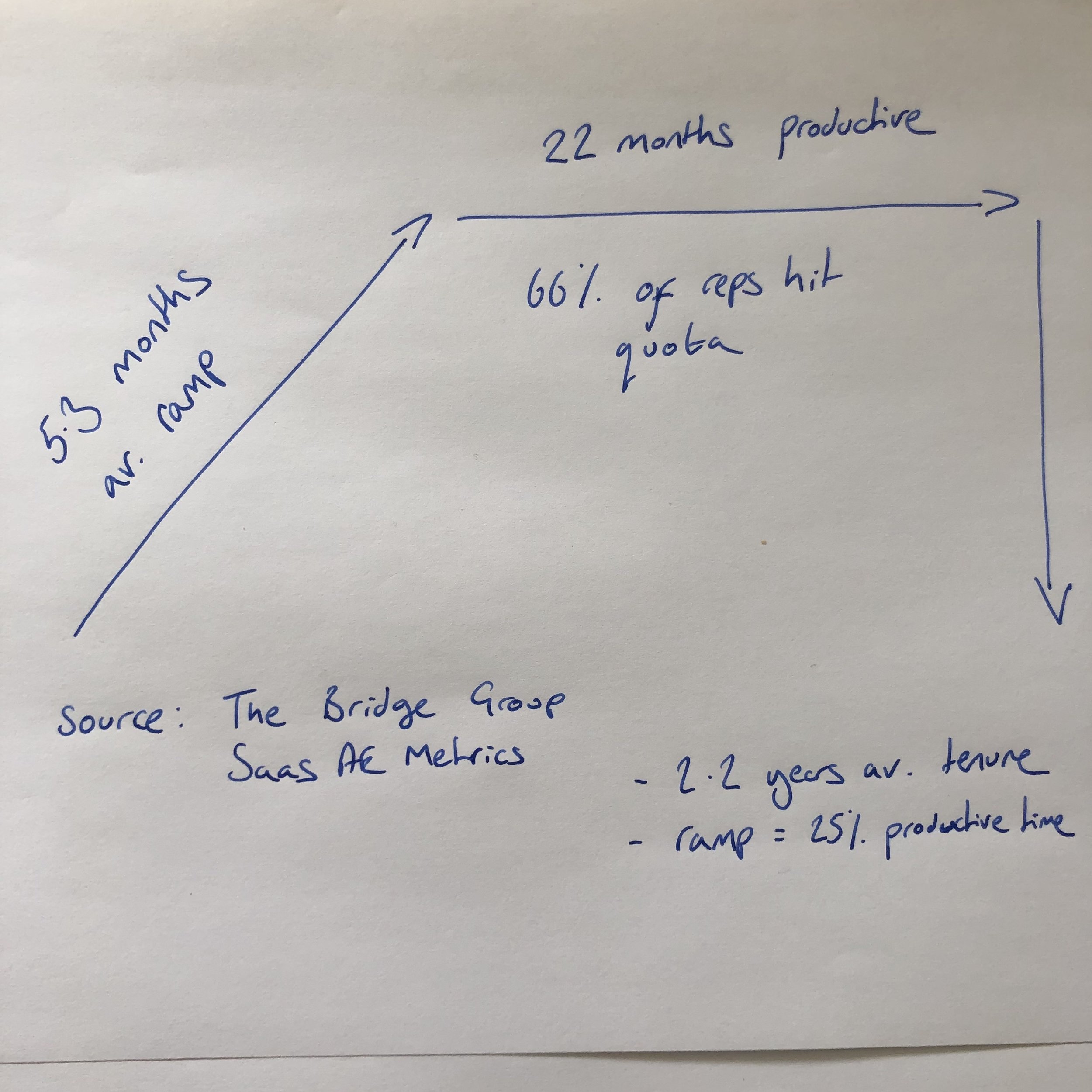

The average productive tenure of a SaaS AE is just 22 months.

After the expense and time of opening the job position, interviewing candidates, making the hire, waiting for the start date, onboarding and ramping - just 22 months before the average AE walks out the door.

This is a huge hit on the efficiency of your go to market teams - just adding a couple of months to the average tenure of your AEs will impact your top and bottom lines.

In your HR platform filter on AEs that had regrettable attrition over the past year - typically these will have been AEs that were performing and then left unexpectedly or performance tailed off and then they left.

Go back to their calls during the time when they were successful and then the time in the weeks before they resigned.

What is different between those calls?

Who else was on the calls?

Was their manager with them and coaching them?

Was there a change in territory, product or pricing?

Were there different competitive pressures introduced?

The answers to these questions will help you to address undiagnosed issues that may not yet be visible in your current top performers.

Call recordings give you a unique perspective on the business

As a leader call recordings can put you into every customer interaction.

But more than that, at scale they can give you a unique perspective to decide where to make investments that can significantly affect the key metrics you are reporting to investors.

Roll-out Gong to help with sales coaching. But don’t stop there - use it to drive your strategic business decisions.

Get started

Whenever you are ready, there are three ways that I can help you accelerate your revenue.

Buyer Experience Audit - I’ll impersonate a buyer researching your segment and company and let you know what I find. Ideal for planning your Revenue Operations strategy.

Business Model Design Workshops - I’ll work with you and your team to design or refine a business model for a new or existing product.

RevOps Impact Playbooks - I’ll help you implement one or more tactical processes across your revenue teams - content, referrals, testimonials, adoption and more.